What is the EU Carbon Border Adjustment Mechanism?

The EU Carbon Border Adjustment Mechanism (CBAM) regulation requires importers into Europe to declare the “embedded GHG emissions” for imported products in six sectors — cement, fertilizer, aluminum, iron & steel, electricity, and hydrogen. These importers must report these declarations each quarter to the CBAM Transitional Registry.

Through 2025, EU CBAM remains in its “transitional phase,” and importers need only declare these emissions. But in 2026, the CBAM “definitive regime” will begin, at which time importers will need to verify their embedded emissions calculations using a third party, and purchase “CBAM certificates”. The price of these certificates will depend upon the weekly average auction price of EU ETS allowances, which generally ranges from 50€ to 100€/ton of CO2 emitted.

In effect, this means that under EU CBAM, importers will pay a carbon tariff on their covered products.

Calculating Embedded GHG Emissions

The EU CBAM regulation provides a detailed methodology on embedded emissions quantification in the three key legislative documents:

To compile the total embedded GHG emissions for their imported products, EU importers must obtain the “specific embedded emissions” (SEE) data from all of the supplier installations from whom they source products. These specific embedded emissions values, calculated in units of ton CO2e per ton of product, are then multiplied by the total product imports to obtain the total embedded GHG emissions.

For example, an importer in Spain, sourcing screws from New Jersey in the USA, must obtain the specific embedded emissions for the supplier. If the specific embedded emissions for the screws are 1.2 tons CO2e per ton, and the importer sources 10 tons of screws from the supplier, then the total embedded GHG emissions are 1.2 x 10 = 12 tons CO2e.

This means that the actual burden of work falls on supplier installations to gather facility data and calculate specific embedded emissions data. Importers must request this data from the suppliers (in practice, importers may also have to pay for their suppliers to do so). Fortunately, the EU Commission provides a template worksheet for suppliers to complete these calculations, called the CBAM Communication Template for Installations, and even, very helpfully, provides example calculations for reference.

What Importers are Required to Do

Importers must “undertake all possible efforts” to obtain emission data from their suppliers of CBAM goods. This applies to any amount of imported goods over the de minimis exemption (EUR 150). If importers are unable to obtain specific embedded emissions data from their suppliers, they must justify the omission and provide supporting documents attesting to the efforts taken to obtain data. In this scenario, the CBAM report will be considered incomplete, and penalties may be assessed on the importer. (See EU CBAM FAQ, Question #76, for more detail.)

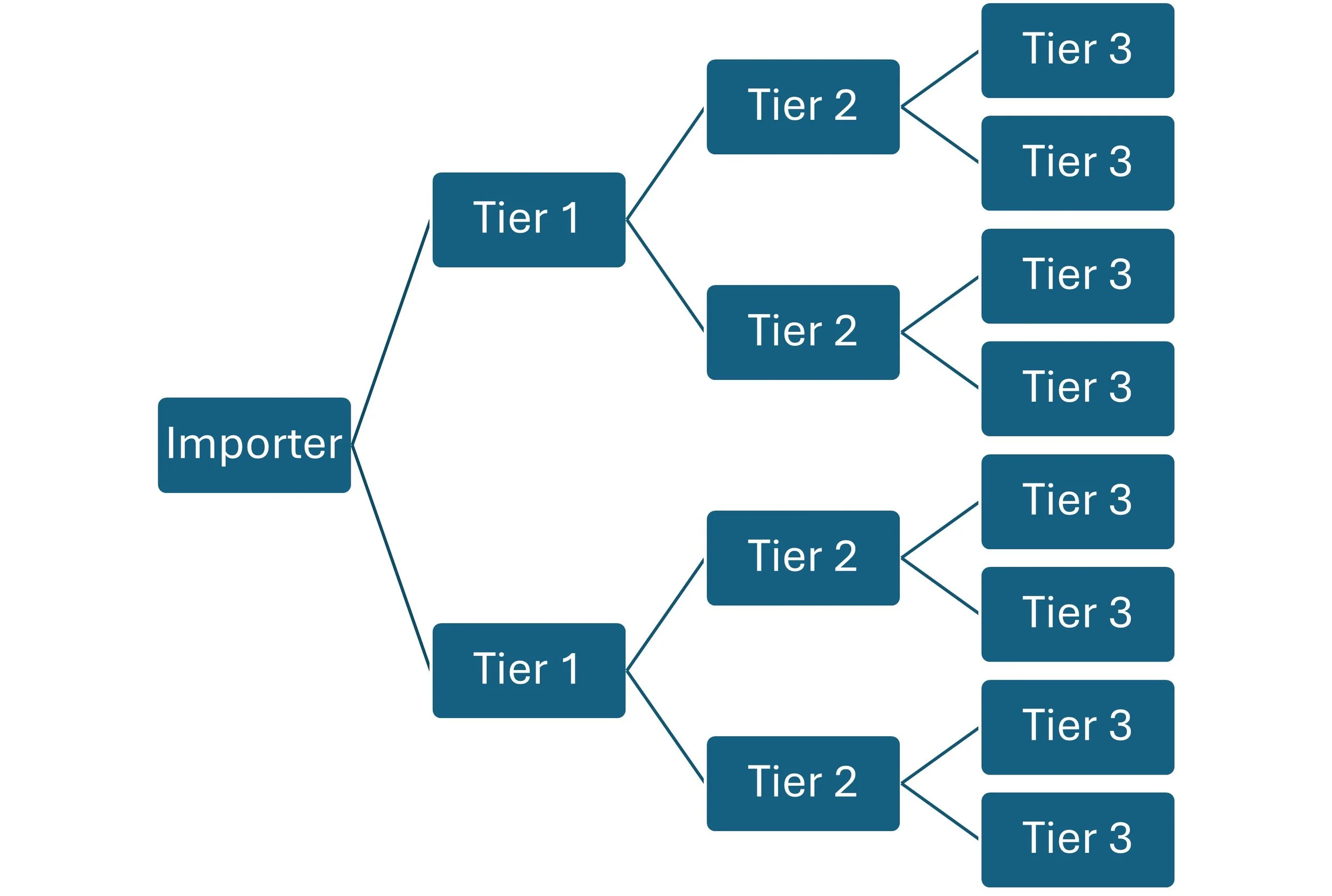

Gathering specific embedded emissions data can be a burdensome process for importers sourcing from large numbers of supplier installations, especially since this requirement applies to suppliers at any depth in the supply chain — importers are required not only to obtain specific embedded emissions data from their “Tier 1” suppliers from whom they source products, but also from the “Tier 2” suppliers providing precursor materials to them.

Gathering specific embedded emissions data can be a burdensome process for importers sourcing from large numbers of supplier installations, especially since this requirement applies to suppliers at any depth in the supply chain — importers are required not only to obtain specific embedded emissions data from their “Tier 1” suppliers from whom they source products, but also from the “Tier 2” suppliers providing precursor materials to them.

Need help in EU CBAM conformance?

If you need support in your EU CBAM conformance, see our EU CBAM consulting services page.

Or you can contact us directly, at info@novacreatio-sustainability.com or visit our Contact Us page.